If you have unpaid debt, the creditor or debt collector can sue you in court to recover the money. The result of such a lawsuit could be a civil judgment (often referred to as just a judgment) against you.

Read on if you need information on removing a judgment from your credit report, including:

Although most judgments no longer appear on credit reports, an old one that remains can still hurt your credit, leading to higher interest rates and making it difficult to apply for new credit. Learn more about the cost of bad credit.

The good news is, if a creditor or debt collector has won a court case against you over unpaid debt and the resulting civil judgment appears on your credit report, you may still be able to have it removed.

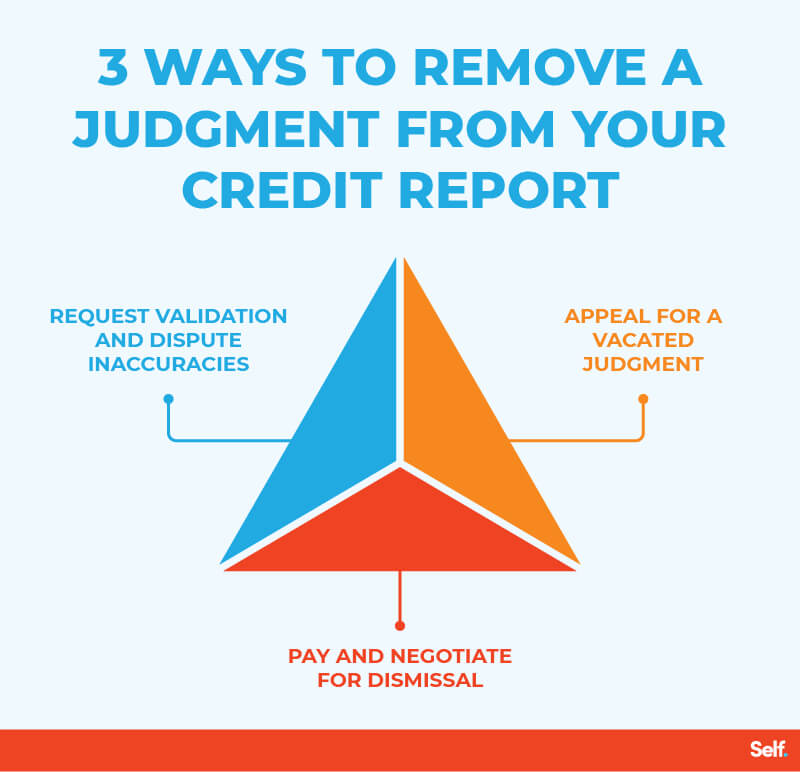

Depending on the specifics of your debt, you may find that requesting validation of the judgment, submitting an appeal to vacate, or paying off the debt and negotiating for its removal from your credit report are all viable options.

A judgment is the result of a lawsuit. When you owe a certain kind of debt and don’t pay it off, the creditor or their debt collection agency may try to recover it by suing you. If the judge rules in favor of your creditor, the court issues a judgment against you.

Not all debt cases go to court. Loans and accounts for certain goods and services, such as credit cards, medical bills and cell phones, may require arbitration instead. [1] But other cases allow debt collectors to go to court in an attempt to recover what they believe you owe them through court judgments.

A judgment might order you to repay the debt by any of several means:

In addition, a judge may order you to pay additional fees to cover costs associated with the original debt collection, interest on what you owe and the plaintiff’s attorney fees. [2]

In the past, civil judgments have appeared in the “public records” section of a credit report, negatively affecting credit scores in the same manner as a tax lien, charge-off or bankruptcy. (Read further to see how these conditions have changed in recent years.)

Five different types of judgment can affect your credit report. It’s a good idea to know how they work and how to approach each one.

A default judgment can occur if you fail to respond to a lawsuit that seeks to collect a debt.

Under the Fair Debt Collections Practices Act, which offers consumers protection against unfair practices by collections agencies, creditors must provide you with a 30-day notice before suing you. (Remember: If you feel you’re being harassed by bill collectors, you have legal options.)

But if, on the other hand, the required 30-day notice has come and gone, and the debt collector does choose to file a suit, you’ll need to respond. If you don’t answer the court order — or you do, but the judge rules in their favor — then the court will issue a judgment penalizing you.

If you fail to appear in court, the judge can rule that the plaintiff suing you has won by default, clearing the way for the creditor to collect the amount owed. Defendants must abide by the ruling even though they weren’t present when it was issued, and they’re subject to punitive action if they fail to comply. [3]

An unsatisfied judgment is one that has not been paid.

A creditor seeking to enforce an unsatisfied judgment becomes a “judgment creditor,” who can seek to recover the amount owed by obtaining a judgment lien under the laws of your state. The judgment creditor can then seek to garnish your wages, seize your bank account, or place a lien against your property — which could then be sold to pay the debt.

A satisfied judgment is one that’s been paid in full. Once a judgment has been paid, the creditor will sign a document called a satisfaction of judgment that acknowledges payment of the debt. [4]

If you’ve satisfied a judgment, it may be to your advantage to further pursue the matter by trying to get that item removed from your credit report.

A vacated judgment is one that’s been declared invalid by the court. A court may vacate a default judgment against you for one of the following reasons:

In such cases, you should be diligent about collecting and preserving all pertinent documentation to back up your position. For examples of solid defenses that can lead to a vacated judgment, see below.

In some states, judgment creditors can renew a judgment even after it’s been vacated or dismissed. In other jurisdictions, debt collectors may be allowed to renew or refile a judgment before the statute of limitations expires, to keep it from expiring and restart.

Under California law, for example, judgments that expire after 10 years are no longer enforceable. But a creditor can renew the judgment for 10 more years, which creates a new filing date and allows a creditor to keep trying to collect. And it can be renewed more than once, although not until five more years have passed. [8]

You’re probably asking at this point, “Is there anything I can do to deal with a judgment that shows up on my credit report?” Depending on the age, nature and accuracy of the judgment, you can try any of several methods to invalidate and remove it.

You can file a request to validate the judgment. A request for validation requires the creditor or debt collection agency to provide details about the debt so you can review them for any inaccuracies.

You can then dispute the inaccurate or outdated information and have the erroneous judgment removed from your credit report under one of several circumstances:

If any of the above conditions are true, you can file a motion to have the judgment vacated. A successfully vacated judgment requires the debt collector to stop pursuing payment of the debt. It also requires credit bureaus to remove the judgment from your credit reports, erasing it as if it had never existed.

Numerous grounds may be valid for getting a judgment against you vacated, such as if the creditor went out of business and there’s no one left for you to pay, or if you’re permanently disabled or on Supplemental Security Income (SSI). You also may be within your rights to challenge the judgment if the creditor breached a warranty or the collection agency violated the Fair Debt Collection Practices Act. [10]

If you believe you have a strong case, it’s better to present it in court than to wait to receive a default judgment and fight it after the fact. If you succeed before a ruling is made, it will keep any judgment from showing up on your credit report. If such early timing isn’t possible, it’s still better to challenge the creditor’s case after the judgment has been made than not at all.

If the judgment was valid, you should try to work out a payment plan with the creditor or collection agency. Repayment of the debt will free you from debt collection efforts and change your judgment to “satisfied” status, which is a step up.

In some states, once a debt is paid, the judgment can be automatically removed from your credit report. If your state does not allow automatic removal, then you can wait for the judgment to disappear from your credit file on its own. [11]

If you’d rather not wait, then you can negotiate to have the paid judgment dismissed, which looks better on your credit report than a judgment that’s simply paid.

Of course, it’s better to address debt and the problems it causes before it becomes a court case. Start by accessing your credit report. Normally, you’re entitled to one free copy of your credit report every year under the Fair Credit Reporting Act.

But in response to COVID-19, the credit bureaus have decided to provide Americans with weekly access to free credit reports. That means you can access your credit reports for free once a week at annualcreditreport.com until April 20, 2022.

Your credit reports will give you access to view your financial history, credit card balances, loan information, and mortgages. Look them over closely to be sure they contain accurate information. Search for any negative items that might seem suspicious; they may signal that you’re a victim of identity theft.

If you need to dispute an item because you’ve been a victim of identity theft, it’s a good idea to follow the steps outlined by the Federal Trade Commission:

Many lenders and credit bureaus will want to see the FTC Identity Theft Report (and some also require a police report) when you dispute an item with them.

Whether you find identity theft or not, it’s important to dispute any items you don’t think you owe with credit reporting agencies, so you can be sure your credit history is accurate and you have the best credit possible. Then you can begin the steps toward credit repair. Your personal finance and FICO® score shouldn’t have to suffer from bad credit because of an error.

In the past, civil judgments pertaining to unpaid debt were reported to the credit bureaus. These can damage your credit report just like a lien, charge-off, bankruptcy, or other debt. However, a 2017 reform in credit reporting practices has changed how judgments appear on credit reports.

The National Consumer Assistance Plan (NCAP) was implemented in 2017 to improve the accuracy of credit reporting by the three major credit bureaus: Equifax, Experian and TransUnion. The new rules required public records data to contain a consumer’s name, address, Social Security number and/or date of birth. [12]

One effect of the NCAP was that reporting civil judgments on credit reports became more difficult. As a result, most judgments are no longer included on consumer credit reports. [13]

Although a judgment may not excessively harm your score, it’s still possible for older judgments to affect your credit score negatively. [14] Using the strategies delineated in this article could help you get a judgment removed and help you begin rebuilding your credit.

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to increase economic inclusion by helping people build credit and savings so they can build their dreams.

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on June 24, 2021 Self is a venture-backed startup that helps people build credit and savings.Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.