Understand the main components of general purpose financial statements. The article also explains further what are these components and their purposes.

by THEACCSENSE April 16, 2021 Updated January 2, 2023

In Accounting 101: Objectives and Users of the General Purpose Financial Statements, we explained what is the general purpose financial statement, the objectives and the users. This time, lets take a look at the components of the general purpose financial statements. For ease of reading, the general purpose financial statements is referred as financial statements in this article.

Financial statements generally have the following five main components:

Balance sheet, profit or loss statement, statement of changes in equity and statement of cash flows are known as the primary statements.

Additionally, you may also come across the following statements:

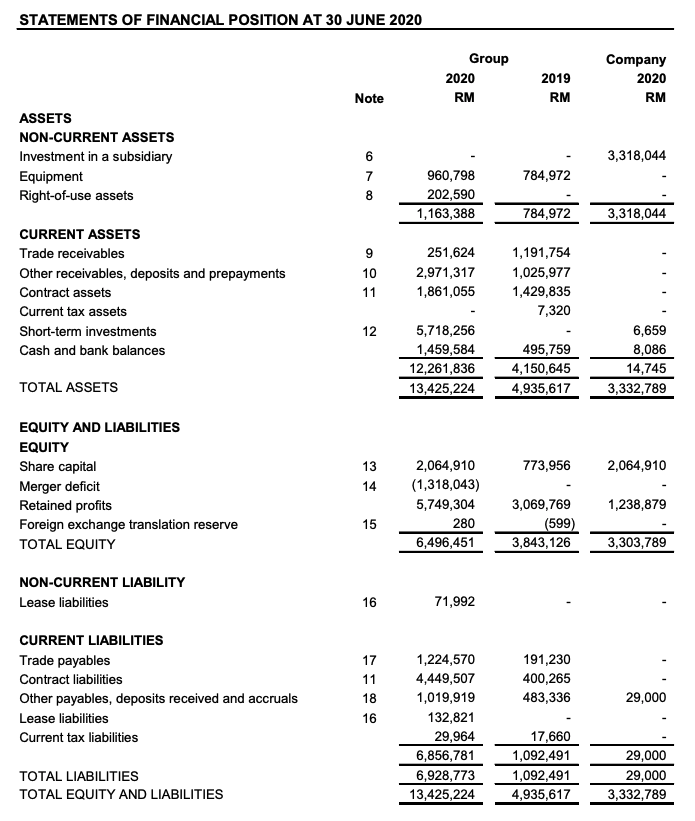

Balance sheet also explains the entity’s net worth – what’s left or remaining for the entity after deducting the liabilities from the assets as at the reporting date. It helps users to understand an entity’s financial standing at the reporting date using various financial ratios. Accordingly, the balance sheet statement is an important source of information with regard to the entity’s liquidity, leverage, efficiency and rates of return.

In this article we use Redplanet Berhad’s audited financial statements as of 30 June 2020. Redplanet Berhad’s statement of financial position is as follows:

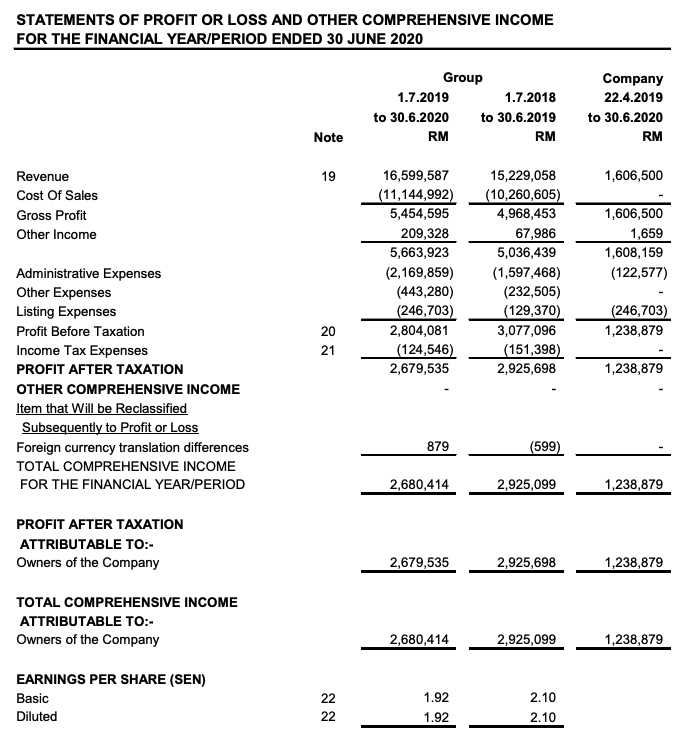

Profit or loss statement is also known as an income statement. It provides information to the users on the financial performance of the entity during the reporting period – i.e., how much profit or loss that the entity made during the reporting period.

Additionally, users are able to see the breakdown of items that made up to such profit or loss in this statement. In fact, users of the financial statements would be able to determine and assess factors or items that contribute to the increase or decrease to the profit or loss as compared to the prior year. If the entity is a listed entity, users of the financial statement will also be provided with the information on earning per share from this statement.

Below is a sample of profit or loss statement of Redplanet Berhad for the financial period ended 30 June 2020:

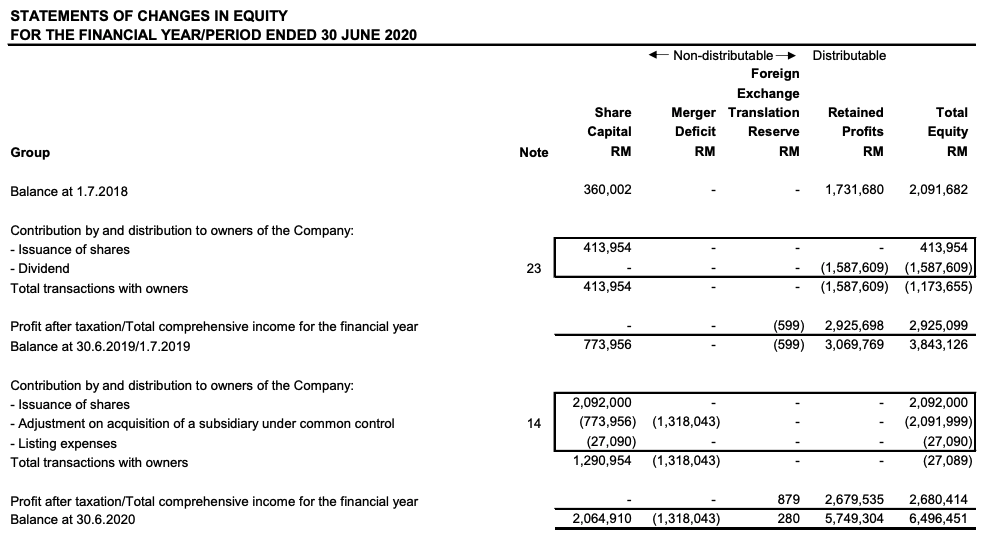

This statement provides information on all the changes that contribute to the movement of the shareholders or owner’s equity or net worth. The movement in shareholder’s equity is contributed from any the following transactions or events:

Below is a sample of the statement of changes in equity of Redplanet for the financial period ended 30 June 2020:

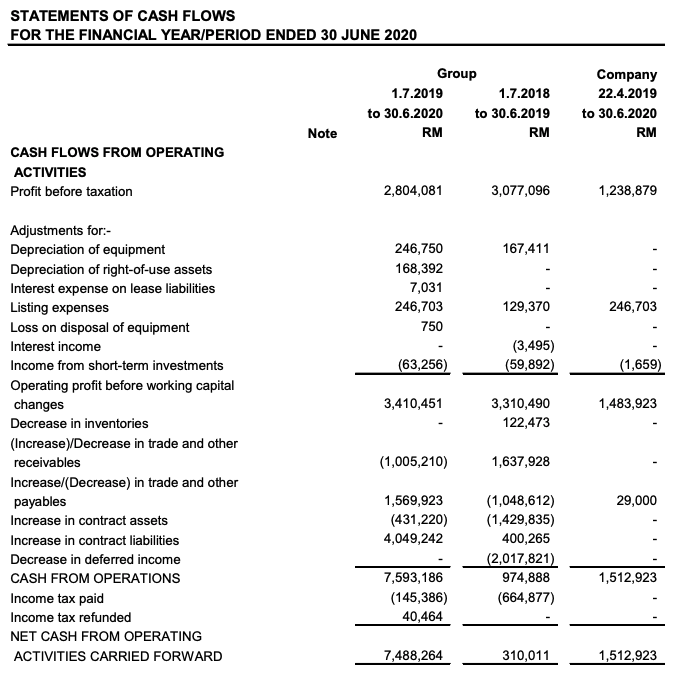

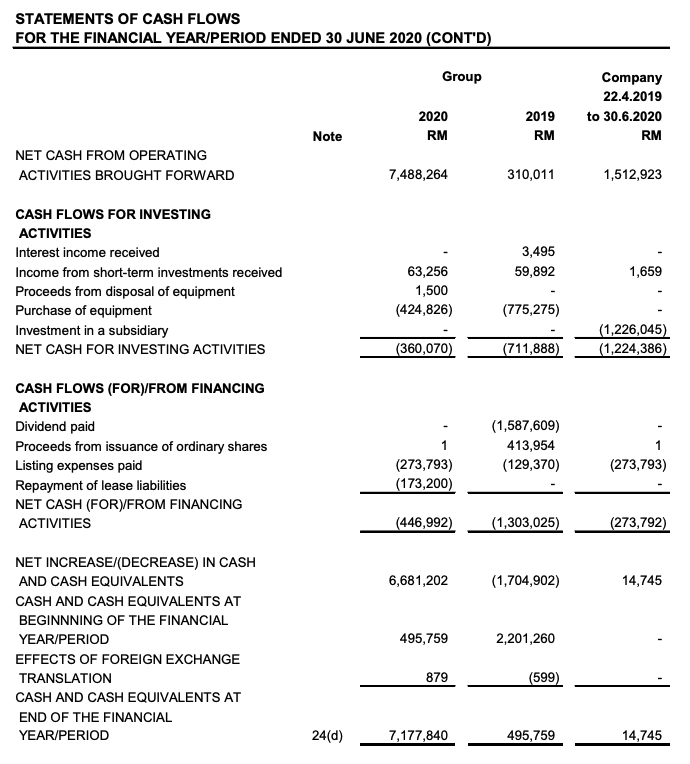

We mentioned in Accounting 101: Introduction to Accounting that most entities prepare their financial statements based on an accrual basis. This is because the accrual method is more reflective of the financial performance of the entity. However, this does not mean cash flow information is not relevant.

Cash is king and is in fact, the lifeblood of any organisation. So, information on cash flows are crucial. For this, cash flows statements provide information on how an entity manages its cash – in and out of cash from the business. In fact, cash flows statements provide users the information on how well an entity manages its cash position, using the cash available to pay its debt and how well the company generates cash to support its business activities.

The statement of cash flows is divided into three main business activities:

The statement of cash flows reconciles the operating profits recorded by the entity. For this, it reconciles the accrual basis of accounting to the actual cash movements (in and out) of the company.

Below is a sample of the statements of cash flows of the Redplanet Berhad for the financial year/period ended 30 June 2020:

The last component of the financial statements is the notes which accompany the primary statements. The role of this component is pretty straightforward – to support the information provided in the primary statements. This component is crucial as it provides further information that is not available elsewhere to support the users’ understanding of the financial standing and performance of the entity.

Take note that entities cannot simply present information required by the primary statements in the notes to the financial statements. For example, an entity cannot presenting changes in equity in the note and hence, not presenting the statement of changes in equity.

Then, why do we need to present the detailed information in the notes but not in the primary statements? This is to avoid the primary statements become over-crowded and messy. Simply said, the primary statements are the high-level summary while the notes are the details.

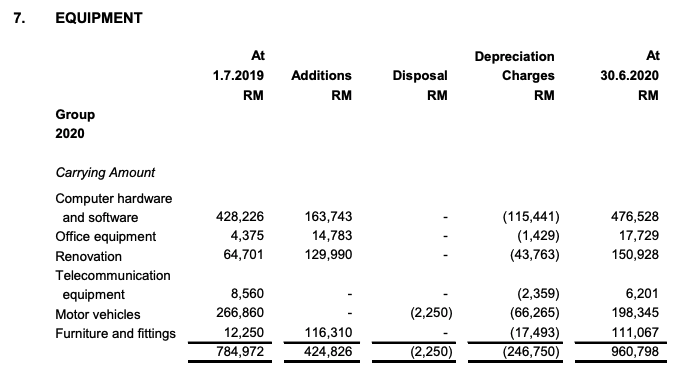

Let’s take an example. In the earlier extract of the balance sheet of Redplanet Berhad, we noted that the equipment of the group as at 30 June 2020 stood at RM960,798, an increase of about RM175,826 or 22% from 30 June 2019. The users may need to know what equipment has the group bought during the financial year? For this, the entity discloses further information in Note 7 of the financial statements as follows:

Based on Note 7 above, users of the financial statements are now able to know that the group has bought computer hardware and software, office equipment and renovation during the financial year. This explains how the notes to the financial statements help to support information provided in the primary statements.

Another interesting note included in this component is the notes on the significant accounting policies adopted by the entity. The note on the significant accounting policies is a crucial note where it disclosed two important information:

These two information are important as they have a direct effect on the financial standing and performance of the entity.

We mentioned in the earlier part of this article that readers may also come across few other statements. This is the case if an entity prepares its financial statements under the IPSAS or AAOIFI framework. We have discussed the comparison of budget and the actual amount in MPSAS 24 Budget Information: Transparency on how public sector utilised budget. Head out to the article to understand what this statement is all about.

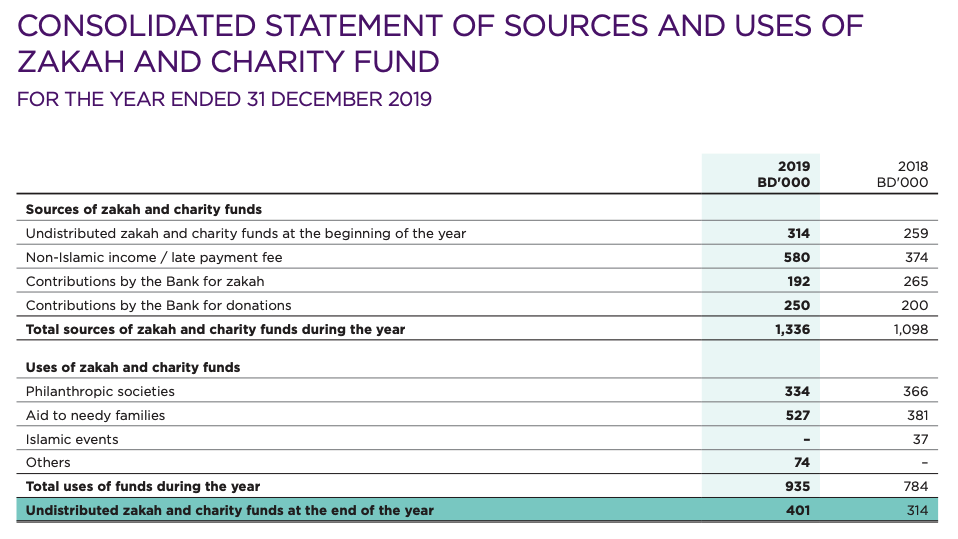

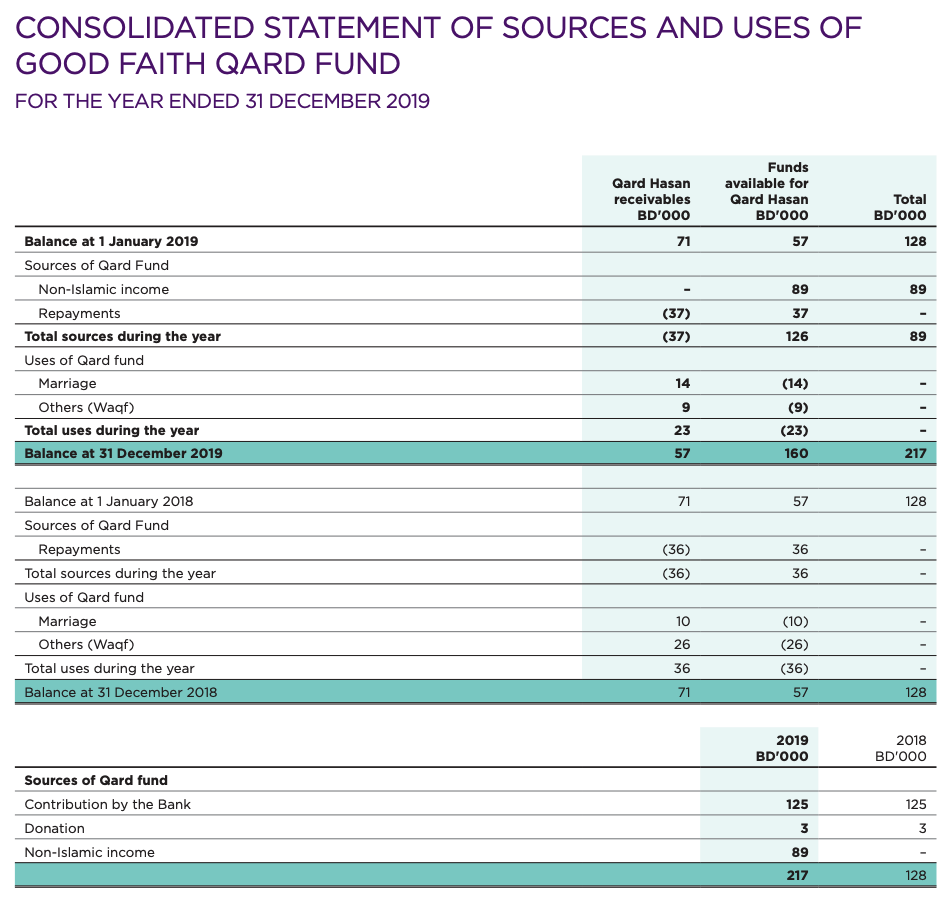

For the additional statements prepared under AAOIFI, the example of the statements that we have extracted from Bahrain Islamic Bank Annual Report 2019 are as follows: